Banking

Silicon Valley Bank, Signature Bank, and Credit Suisse, 2023

Fig. 1. “The monument sign in front of the parking lot of the Silicon Valley Bank headquarters at 3003 West Tasman Drive, Santa Clara, California.” Photograph by Minh Nguyen, March 13, 2023, via Wikimedia Commons, CC BY-SA 4.0.

The New York Times argues that the bank collapses are really a big deal,[1] which raises an implication that they felt they needed to make this argument, which in turn suggests that they feel people aren’t taking it seriously enough.

The three [Silicon Valley, Signature, and First Republic] banks held a total of $532 billion in assets. That’s more than the $526 billion, when adjusted for inflation, held by the 25 banks that collapsed in 2008 at the height of the global financial crisis.[2]

But this might be the start of the recession everyone has been yammering about:[3]

“There is a little bit of a tendency to kind of breathe a sigh of relief on mornings like this,” David Hunt, chief executive of $1.2tn asset manager PGIM, told Milken attendees digesting the First Republic rescue. “Actually, we’re just starting the implications for the US economy.”

“First of all, we’re going to see a real ratcheting-up of regulation in the banking system, particularly on many . . . regional lenders,” said Hunt, adding that the impact of new rules would be “quite constraining”.

“What that will do is . . . further hinder the supply of credit that’s going into the economy. And I think that we are going to see now a real slowing that begins to happen to aggregate demand.”[4]

![]()

Fig. 2. “Top 50 banks by share of deposits that are not federally insured[,] [e]xclud[ing] banking giants considered systemically important . . . Sources: Federal Financial Institutions Examination Council; Financial Stability Board Notes: Data is as of Dec. 31, 2022. Includes domestic deposits only. Excludes global systemically important banks, which are subject to more stringent regulations, including tougher capital requirements.” Graphic by Ella Koeze, May 1, 2023, via the New York Times,[5] fair use.

Something the Times emphasizes, however, is that the three banks had disproportionately large shares of uninsured (exceeding the Federal Deposit Insurance Corporation $250,000 limit) deposits. Their graphic (figure 2) shows that there are at least four other banks, which they don’t identify (The Financial Times names Pacific Western [“PacWest”] and Western Alliance[6]), that might be comparably subject to bank runs.[7] The question is whether those runs actually happen, which is all about two factors:

- Psychology with some basis in reality,[8] and with commercial real estate problems also looming.[9]

- Depositors’ needs for money, as with Silicon Valley Bank and technology companies needing, among other things, to make payroll and cloud computing payments[10]

So another piece of this isn’t just that we’re looking at a tightening of credit due to a regulatory crackdown due to bank failures that have already happened,[11] but as well to the crackdown which may occur as a consequence of bank failures yet to happen (and still might not).

One banking analyst pointed to a caveat in comments made by JPMorgan Chase chief executive Jamie Dimon after the First Republic takeover. Although he said the rescue of the California bank on Monday “pretty much resolves them all”, he prefaced his remarks with the warning that “there may be another smaller one” to come.

“People are latching on to that comment,” the analyst said.[12]

Lauren Hirsch, Maureen Farrell, and Jeanna Smialek, “Regulators Prepare to Seize and Sell First Republic,” New York Times, April 30, 2023, https://www.nytimes.com/2023/04/29/business/first-republic-seizure-fdic.html

Telis Demos and Aaron Back, “With First Republic, JPMorgan’s Dimon Gets Over Financial Crisis Laments,” Wall Street Journal, May 1, 2023, https://www.wsj.com/articles/with-first-republic-jpmorgans-dimon-gets-over-financial-crisis-laments-6d19041f

Rachel Louise Ensign and Ben Eisen, “First Republic Bank Is Seized, Sold to JPMorgan in Second-Largest U.S. Bank Failure,” Wall Street Journal, May 1, 2023, https://www.wsj.com/articles/first-republic-bank-is-seized-sold-to-jpmorgan-in-second-largest-u-s-bank-failure-5cec723

Jennifer Hughes and Antoine Gara, “Investors warn of First Republic aftershocks at gloomy Milken gathering,” Financial Times, May 1, 2023, https://www.ft.com/content/08907106-b792-4b94-b14e-f2d38c72bc48

Rachel Louise Ensign et al., “Why First Republic Bank Collapsed,” Wall Street Journal, May 1, 2023, https://www.wsj.com/articles/first-republic-bank-collapse-why-banking-crisis-61660d96

Karl Russell and Christine Zhang, “3 Failed Banks This Year Were Bigger Than 25 That Crumbled in 2008,” New York Times, May 1, 2023, https://www.nytimes.com/interactive/2023/business/bank-failures-svb-first-republic-signature.html

Financial Times, “First Republic/JPMorgan: small deal has big implications,” May 2, 2023, https://www.ft.com/content/917878b6-713a-4acb-aa71-2254819ae245

Brooke Masters et al., “First Republic rescue fails to arrest slide in US regional bank shares,” Financial Times, May 2, 2023, https://www.ft.com/content/32342f88-2d24-4198-90f1-89eb23bd1def

Commercial real estate

Fig. 3. “The iconic Crescent stands as recognizable landmark in the upscale neighborhood of Uptown, Dallas.” Photograph by Dallasedits [pseud.], July 5, 2016, via Wikimedia Commons, CC BY-SA 4.0.

Jake Blumgart and Chris A. Williams, “Philly-area workers prefer to work from home, leaving millions of square feet of office space vacant,” Philadelphia Inquirer, May 2, 2023, https://www.inquirer.com/real-estate/commercial/office-building-vacancy-hybrid-work-sublease-20230502.html

So-called ‘ridesharing’

Bezzle

Fig. 4. “Clarkdale Classic Gas Station, Clarkdale, Arizona,” Photograph by Alan Levine, October 28, 2016, via Wikimedia Commons, CC0.

Dan Gallagher, “Uber Is Firing on the Most Important Cylinders,” Wall Street Journal, May 2, 2023, https://www.wsj.com/articles/uber-is-firing-on-the-most-important-cylinders-83fcfdd4

Work

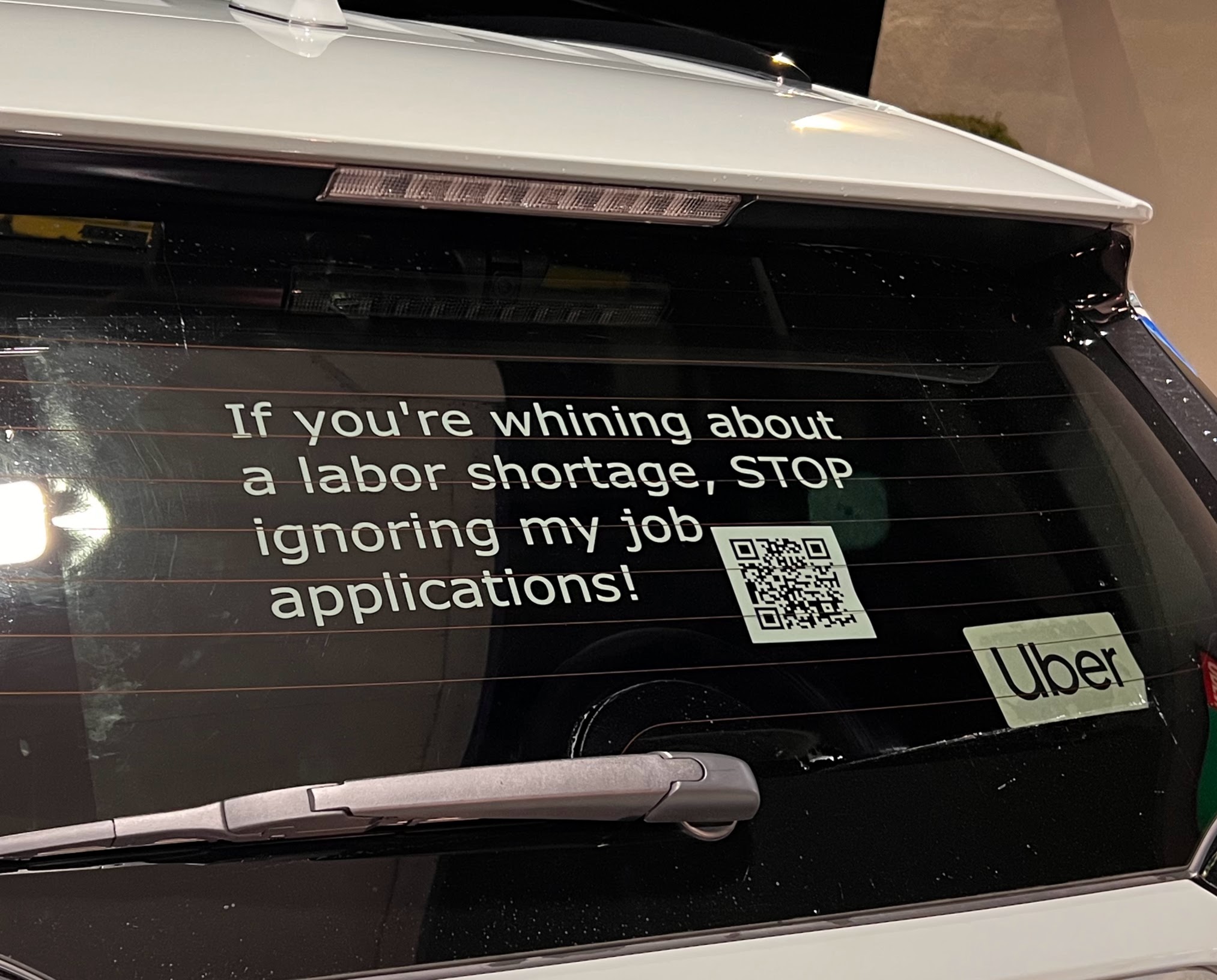

Fig. 5. Yeah, this is me. The sign says, “If you’re whining about a labor shortage, STOP ignoring my job applications!” And the QR-code leads here. Photograph by author, January 16, 2023.

The Labor Department on Tuesday reported that there were 9.59 million unfilled jobs in the U.S. at the end of March, down from 9.974 million at the end of February, and 20% below the record 12.027 million logged in March of last year.[13]

And not one of these mother fuckers will hire me. Not one.

Justin Lahart, “Help Still Wanted: Fewer Job Openings Won’t Faze the Fed,” Wall Street Journal, May 2, 2023, https://www.wsj.com/articles/help-still-wanted-fewer-job-openings-wont-faze-the-fed-6afb3424

Gilead

Academic repression

Student loans

Fig. 6. Unattributed and undated image via James G. Martin Center for Academic Renewal,[14] fair use.

Erum Salam, “US states opposing student loan forgiveness made false claims, files reveal,” Guardian, May 2, 2023, https://www.theguardian.com/money/2023/may/02/student-loan-forgiveness-supreme-court-us-states-false-claims

Fig. 7. “Elon Musk shared a video of his entrance on his Twitter account.” Photograph attributed to Elon Musk, October 26, 2022, via the New York Post,[15] fair use.

If this [Elon Musk’s threat to reassign the @NPR handle] is a sign of things to come on Twitter, we might soon see even more of a rapid retreat by media organizations and other brands that don’t think it’s worth the risk. It’s really an extraordinary threat to make.[16]

Bobby Allyn, “Elon Musk threatens to re-assign @NPR on Twitter to ‘another company,’” National Public Radio, May 2, 2023, https://www.npr.org/2023/05/02/1173422311/elon-musk-npr-twitter-reassign

Imperialism

Russia

Ukraine

Fig. 8. “Destroyed Russian military vehicles located on the main street Khreshchatyk are seen as part of the celebration of the Independence Day of Ukraine in Kyiv, August 24.” Photograph by Gleb Garanich for Reuters, August 24, 2022,[17] fair use.

Samantha de Bendern, “Putin claims he’s cancelling public celebrations over safety fears. The truth is more humiliating,” Guardian, May 2, 2023, https://www.theguardian.com/commentisfree/2023/may/02/putin-cancelling-public-celebrations-safety-fears-ukraine-war

Quantum computing

There are, we are to understand, two big problems with quantum computing. The first is that it isn’t here yet:

[Peter Shor’s] best guess as to when this [several conceptual breakthroughs and a huge engineering effort before we can scale quantum computers to the necessary 1mn qubits needed for his algorithm] might happen? “I would predict between 20 and 40 years,” he says. But he does not rule out the possibility that the physics challenges will prove too hard and we will never build workable quantum computers.[18]

The second is that Peter Shor’s algorithm, which requires a “workable quantum computer,” purportedly cracks the Rivest-Shamir-Adleman (RSA) algorithm used to encrypt most secure traffic on the web. Suddenly, an awful lot of secure traffic won’t be any more for anyone suitably (expensively) equipped.[19]

The existence of Shor’s algorithm is why I’ve generally preferred elliptic curve cryptography—send an encrypted email message to me and you’ll be encrypting to an elliptic curve cryptography 25519 key—even if I haven’t always used it, but apparently elliptic curve cryptography is also vulnerable to quantum computing, which means there is still a need for an encryption algorithm that will resist quantum computing.[20] Fortunately, I won’t need to solve this problem for a while.[21]

Sam Learner et al., “Quantum computing could break the internet. This is how,” Financial Times, May 3, 2023, https://ig.ft.com/quantum-computing/

- [1]Karl Russell and Christine Zhang, “3 Failed Banks This Year Were Bigger Than 25 That Crumbled in 2008,” New York Times, May 1, 2023, https://www.nytimes.com/interactive/2023/business/bank-failures-svb-first-republic-signature.html↩

- [2]Karl Russell and Christine Zhang, “3 Failed Banks This Year Were Bigger Than 25 That Crumbled in 2008,” New York Times, May 1, 2023, https://www.nytimes.com/interactive/2023/business/bank-failures-svb-first-republic-signature.html↩

- [3]Nicole Goodkind to Before the Bell list, “Three scenarios for the US economy going forward,” CNN, May 2, 2023, https://www.cnn.com/specials/investing/before-the-bell; Jennifer Hughes and Antoine Gara, “Investors warn of First Republic aftershocks at gloomy Milken gathering,” Financial Times, May 1, 2023, https://www.ft.com/content/08907106-b792-4b94-b14e-f2d38c72bc48↩

- [4]Jennifer Hughes and Antoine Gara, “Investors warn of First Republic aftershocks at gloomy Milken gathering,” Financial Times, May 1, 2023, https://www.ft.com/content/08907106-b792-4b94-b14e-f2d38c72bc48↩

- [5]Karl Russell and Christine Zhang, “3 Failed Banks This Year Were Bigger Than 25 That Crumbled in 2008,” New York Times, May 1, 2023, https://www.nytimes.com/interactive/2023/business/bank-failures-svb-first-republic-signature.html↩

- [6]Brooke Masters et al., “First Republic rescue fails to arrest slide in US regional bank shares,” Financial Times, May 2, 2023, https://www.ft.com/content/32342f88-2d24-4198-90f1-89eb23bd1def↩

- [7]Karl Russell and Christine Zhang, “3 Failed Banks This Year Were Bigger Than 25 That Crumbled in 2008,” New York Times, May 1, 2023, https://www.nytimes.com/interactive/2023/business/bank-failures-svb-first-republic-signature.html↩

- [8]Jennifer Hughes and Antoine Gara, “Investors warn of First Republic aftershocks at gloomy Milken gathering,” Financial Times, May 1, 2023, https://www.ft.com/content/08907106-b792-4b94-b14e-f2d38c72bc48; Izabella Kaminska, “Bad bonds risk bringing down banks, warns ‘Dr Doom,’” Politico, March 16, 2023, https://www.politico.eu/article/bad-bonds-risk-bringing-down-banks-warns-dr-doom-nouriel-roubini-svb/; Brooke Masters et al., “First Republic rescue fails to arrest slide in US regional bank shares,” Financial Times, May 2, 2023, https://www.ft.com/content/32342f88-2d24-4198-90f1-89eb23bd1def; Nouriel Roubini, “‘Most U.S. banks are technically near insolvency, and hundreds are already fully insolvent,’ Roubini says,” MarketWatch, April 1, 2023, https://www.marketwatch.com/story/most-u-s-banks-are-technically-near-insolvency-and-hundreds-are-already-fully-insolvent-roubini-says-18b89f92↩

- [9]Eric Platt and Harriet Agnew, “Charlie Munger: US banks are ‘full of’ bad commercial property loans,” Financial Times, April 30, 2023, https://www.ft.com/content/da9f8230-2eb1-49c5-b63a-f1507936d01b↩

- [10]Adam Cancryn, Ben White, and Victoria Guida, “How Biden saved Silicon Valley startups: Inside the 72 hours that transformed U.S. banking,” Politico, March 13, 2023, https://www.politico.com/news/2023/03/13/the-emergency-bank-rescue-that-almost-didnt-happen-72-hours-00086868; Ben Foldy, Rachel Louise Ensign, and Justin Baer, “How Silicon Valley Turned on Silicon Valley Bank,” Wall Street Journal, March 12, 2023, https://www.wsj.com/articles/how-silicon-valley-turned-on-silicon-valley-bank-ee293ac9; Jeff Stein, “Is this a bailout and 6 other questions about the SVB collapse,” Washington Post, March 13, 2023, https://www.washingtonpost.com/us-policy/2023/03/13/svb-bank-bailout-fed/; Jeff Stein et al., “U.S. says ‘all’ deposits at failed bank will be available Monday,” Washington Post, March 12, 2023, https://www.washingtonpost.com/us-policy/2023/03/12/silicon-valley-bank-deposits/; Nick Timiraos, “SVB, Signature Bank Depositors to Get All Their Money as Fed Moves to Stem Crisis,” Wall Street Journal, March 12, 2023, https://www.wsj.com/articles/federal-reserve-rolls-out-emergency-measures-to-prevent-banking-crisis-ba4d7f98↩

- [11]Jennifer Hughes and Antoine Gara, “Investors warn of First Republic aftershocks at gloomy Milken gathering,” Financial Times, May 1, 2023, https://www.ft.com/content/08907106-b792-4b94-b14e-f2d38c72bc48↩

- [12]Brooke Masters et al., “First Republic rescue fails to arrest slide in US regional bank shares,” Financial Times, May 2, 2023, https://www.ft.com/content/32342f88-2d24-4198-90f1-89eb23bd1def↩

- [13]Justin Lahart, “Help Still Wanted: Fewer Job Openings Won’t Faze the Fed,” Wall Street Journal, May 2, 2023, https://www.wsj.com/articles/help-still-wanted-fewer-job-openings-wont-faze-the-fed-6afb3424↩

- [14]Richard K. Vedder, “Eliminate or Radically Restructure Federal Student Loans,” James G. Martin Center for Academic Renewal, September 16, 2020, https://www.jamesgmartin.center/2020/09/eliminate-or-radically-restructure-federal-student-loans/↩

- [15]Thomas Barrabi, “Elon Musk barges into Twitter HQ as deal nears: ‘Let that sink in,’” New York Post, October 26, 2022, https://nypost.com/2022/10/26/elon-musk-barges-into-twitter-headquarters-as-deal-nears/↩

- [16]Emily Bell, quoted in Bobby Allyn, “Elon Musk threatens to re-assign @NPR on Twitter to ‘another company,’” National Public Radio, May 2, 2023, https://www.npr.org/2023/05/02/1173422311/elon-musk-npr-twitter-reassign↩

- [17]Reuters, “Ukraine puts destroyed Russian tanks on display in Kyiv,” August 25, 2022, https://www.reuters.com/news/picture/ukraine-puts-destroyed-russian-tanks-on-idUSRTSALV9Q↩

- [18]Sam Learner et al., “Quantum computing could break the internet. This is how,” Financial Times, May 3, 2023, https://ig.ft.com/quantum-computing/↩

- [19]Sam Learner et al., “Quantum computing could break the internet. This is how,” Financial Times, May 3, 2023, https://ig.ft.com/quantum-computing/↩

- [20]namcios [pseud.], “GnuPG now uses ECC 25519 as default on new key generation – any compatibility issues to worry about?” Stack Exchange, August 6, 2021, https://security.stackexchange.com/questions/254045/gnupg-now-uses-ecc-25519-as-default-on-new-key-generation-any-compatibility-is↩

- [21]Sam Learner et al., “Quantum computing could break the internet. This is how,” Financial Times, May 3, 2023, https://ig.ft.com/quantum-computing/↩