Banking

Fig. 1. “East River Savings Bank,” apparently now a CVS drug store. Photograph by Jim Henderson, July 3, 2021, via Wikimedia Commons, CC BY 4.0.

The previous issue, which dealt with contagion to Credit Suisse,[1] has been updated. Now we’re looking at SoftBank, which “isn’t a bank,” but “has bankrolled many tech startups.”[2] Seems like there are an awful lot of fires to put out.

The [Silicon Valley Bank] collapse could bring forward the “day of reckoning” for [venture capitalists] and private-equity funds and force them to mark down the value of their holdings in private startups, says Atul Goyal, an analyst at Jefferies.

There has been a widening discrepancy between valuations in public and private markets in recent months. The 50 largest tech companies that have gone public since 2020 have lost nearly 60%, or more than $600 billion, of their combined market value, according to CB Insights. On the other hand, median valuations for late stage, privately held startups last quarter were still above 2020 levels. Partly, that’s because only stronger startups managed to raise capital amid the deepening funding winter last year. But if the SVB debacle forces more startups to reluctantly seek equity funding, that could push valuations lower.

That would be a problem for SoftBank, which has invested in hundreds of startups through the $100 billion Vision Fund and its successor. Jefferies estimates that SoftBank has only written down the unlisted holdings at its Vision funds by 20%, compared with a more than 50% drop in the value of its listed portfolio since the beginning of 2022.[3]

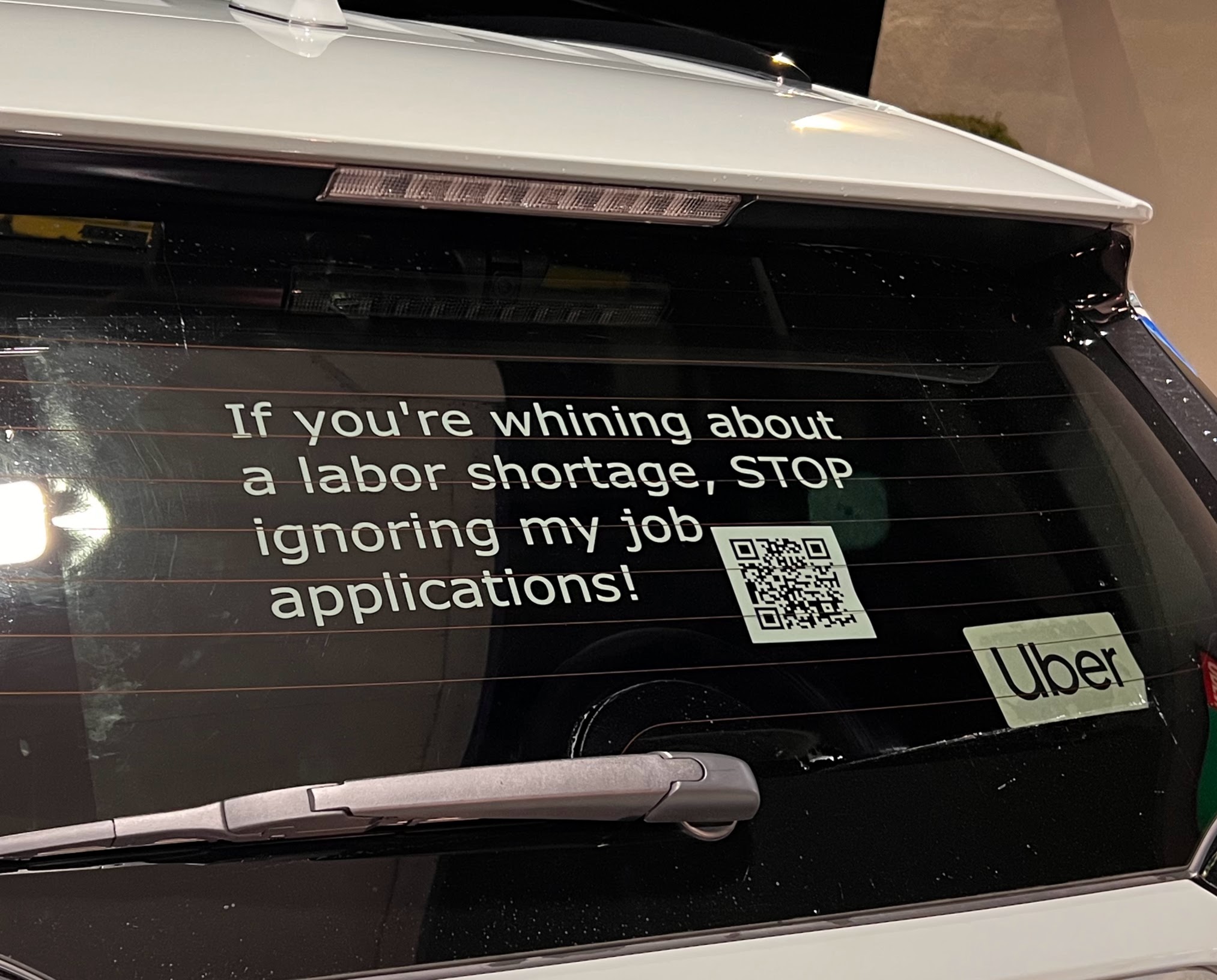

We’ve been seeing signs of stress in the technology sector for a while now,[4] which I kinda have to pay attention to because Uber and Lyft style themselves as and are treated as “technology companies” as part of their “independent contractor” scam on drivers—they are part of this ecosystem.

It appears that SoftBank sold off the last of its Uber holdings last year,[5] so there should be no direct impact.

But it seems possible that that a focus on banking may be too narrow. It looks like venture capital is up to its neck in the Silicon Valley Bank collapse.[6] If we see these vultures as a cause, as they were of the dot-com crash in 2001, and if we see them folding up their checkbooks as they did in 2001, then we could be looking at a feedback loop that may yet be unchecked; this in turn could—I’m not forecasting this—lead to another crash.

A couple days ago, I wrote that

I think the conclusion here is that a $250,000 limit on Federal Deposit Insurance Corporation coverage is simply the wrong approach to this problem. Large companies need large checking account balances to make payroll and pay their bills and, setting aside arguments about capitalism, the nature and function of money, etc., we probably would acknowledge that these are legitimate balances that should be protected.[7]

Now I’m thinking it isn’t just “systemically important” banks that are the problem here. We’ve got entire corporations even outside that sector that are “too big to fail,” but are on precarious venture capital footing. And if that’s the case, then fixing the $250,000 limit isn’t really the fix: We need to at the very least to 1) limit the size of companies that rely on this kind of financing, and 2) find ways to limit the power of venture capital over the economy. Even if my analysis is incorrect, these measures would be good things in themselves.

Brian Chappatta, “SVB’s 44-Hour Collapse Was Rooted in Treasury Bets During Pandemic,” Bloomberg, March 10, 2023, https://www.bloomberg.com/news/articles/2023-03-10/svb-spectacularly-fails-after-unthinkable-heresy-becomes-reality

Saleha Mohsin, Lydia Beyoud and Sridhar Natarajan, “FDIC Races to Return Some Uninsured SVB Deposits Monday,” Bloomberg, March 11, 2023, https://www.bloomberg.com/news/articles/2023-03-11/fdic-races-to-start-returning-some-uninsured-svb-deposits-monday

Associated Press, “US government: Silicon Valley Bank clients will get funds,” March 12, 2023, https://apnews.com/article/silicon-valley-bank-bailout-yellen-deposits-failure-94f2185742981daf337c4691bbb9ec1e

William D. Cohan, “SVB’s Valley of Death,” Puck, March 12, 2023, https://puck.news/svbs-valley-of-death/

Ben Foldy, Rachel Louise Ensign, and Justin Baer, “How Silicon Valley Turned on Silicon Valley Bank,” Wall Street Journal, March 12, 2023, https://www.wsj.com/articles/how-silicon-valley-turned-on-silicon-valley-bank-ee293ac9

Victoria Guida and Sam Sutton, “‘There’s going to be more’: How Washington is bracing for bank fallout,” Politico, March 12, 2023, https://www.politico.com/news/2023/03/12/silicon-valley-bank-fallout-washington-00086662

Jeff Stein et al., “U.S. says ‘all’ deposits at failed bank will be available Monday,” Washington Post, March 12, 2023, https://www.washingtonpost.com/us-policy/2023/03/12/silicon-valley-bank-deposits/

Nick Timiraos, “SVB, Signature Bank Depositors to Get All Their Money as Fed Moves to Stem Crisis,” Wall Street Journal, March 12, 2023, https://www.wsj.com/articles/federal-reserve-rolls-out-emergency-measures-to-prevent-banking-crisis-ba4d7f98

Zachary Warmbrodt, “Banks fought to fend off tougher regulation. Then the meltdown came,” Politico, March 12, 2023, https://www.politico.com/news/2023/03/12/banks-regulations-feds-svb-meltdown-00086694

Adam Cancryn, Ben White, and Victoria Guida, “How Biden saved Silicon Valley startups: Inside the 72 hours that transformed U.S. banking,” Politico, March 13, 2023, https://www.politico.com/news/2023/03/13/the-emergency-bank-rescue-that-almost-didnt-happen-72-hours-00086868

John Cassidy, “The Old Policy Issues Behind the New Banking Turmoil,” New Yorker, March 13, 2023, https://www.newyorker.com/news/our-columnists/the-old-policy-issues-behind-the-new-banking-turmoil

Telis Demos, “Were SVB and Signature Bank Just Bailed Out by the U.S. Government?” Wall Street Journal, March 13, 2023, https://www.wsj.com/articles/were-banks-just-bailed-out-by-the-government-6b0a582f

Eric Lutz, “The Silicon Valley Bank Crisis Is Complicated. But Donald Trump’s Role In It Isn’t,” Vanity Fair, March 13, 2023, https://www.vanityfair.com/news/2023/03/silicon-valley-bank-collapse

David J. Lynch and Tony Romm, “Washington’s bank rescue fails to erase all doubts,” Washington Post, March 13, 2023, https://www.washingtonpost.com/us-policy/2023/03/13/silicon-valley-bank-doubts/

Jeff Stein, “Is this a bailout and 6 other questions about the SVB collapse,” Washington Post, March 13, 2023, https://www.washingtonpost.com/us-policy/2023/03/13/svb-bank-bailout-fed/

Zachary D. Carter, “This Bank Panic Should Not Exist,” Vanity Fair, March 14, 2023, https://www.vanityfair.com/news/2023/03/silicon-valley-bank-run-panic-should-not-exist

Myriam Balezou, “Credit Suisse Is In Crisis. What Went Wrong?” Bloomberg, March 15, 2023, https://www.bloomberg.com/news/articles/2023-03-15/credit-suisse-what-s-going-on-and-why-is-cs-stock-falling

William D. Cohan, “Two Days in the Valley,” Puck, March 15, 2023, https://puck.news/two-days-in-the-valley/

Simon Foy, “Is Credit Suisse, the bad apple of European banking, really ‘too big to fail, too big to be saved’?” Telegraph, March 16, 2023, https://www.telegraph.co.uk/business/2023/03/15/credit-suisse-share-price-bailout/

Nicholas Jasinski, “How SVB Triggered Credit Suisse’s Latest Mess—and Sparked Fears of a Financial Crisis,” Barron’s, March 15, 2023, https://www.barrons.com/articles/credit-suisse-svb-banking-crisis-3faac588

Brian Swint, “Credit Suisse Stock Surges as Central Bank Loan and Debt Buybacks Tame Panic,” Barron’s, March 16, 2023, https://www.barrons.com/articles/credit-suisse-buy-back-debt-svb-banks-crisis-bf792d0d

Stephen Wilmot, “Panic Abates at Credit Suisse. Now Comes the Hard Part,” Wall Street Journal, March 16, 2023, https://www.wsj.com/articles/panic-abates-at-credit-suisse-now-comes-the-hard-part-2b93c578

Jacky Wong, “The SVB Tremors Will Shake SoftBank,” Wall Street Journal, March 16, 2023, https://www.wsj.com/articles/the-svb-tremors-will-shake-softbank-dc7fab4

Pennsylvania

Pittsburgh

Unauthorized violence

Fig. 1. “Ed Gainey poses with CeaseFirePA during the 2020 Women’s March in Downtown Pittsburgh.” Photograph by Megan Gloeckler, undated, via Pittsburgh City Paper,[8] fair use.

Laura Malt Schneiderman, “Gang violence in Pittsburgh has given way to a new, less organized form of crime,” Pittsburgh Post-Gazette, March 16, 2023, https://newsinteractive.post-gazette.com/pittsburgh-gang-violence-organized-crime/

- [1]Myriam Balezou, “Credit Suisse Is In Crisis. What Went Wrong?” Bloomberg, March 15, 2023, https://www.bloomberg.com/news/articles/2023-03-15/credit-suisse-what-s-going-on-and-why-is-cs-stock-falling; Simon Foy, “Is Credit Suisse, the bad apple of European banking, really ‘too big to fail, too big to be saved’?” Telegraph, March 16, 2023, https://www.telegraph.co.uk/business/2023/03/15/credit-suisse-share-price-bailout/; Nicholas Jasinski, “How SVB Triggered Credit Suisse’s Latest Mess—and Sparked Fears of a Financial Crisis,” Barron’s, March 15, 2023, https://www.barrons.com/articles/credit-suisse-svb-banking-crisis-3faac588; Brian Swint, “Credit Suisse Stock Surges as Central Bank Loan and Debt Buybacks Tame Panic,” Barron’s, March 16, 2023, https://www.barrons.com/articles/credit-suisse-buy-back-debt-svb-banks-crisis-bf792d0d↩

- [2]Jacky Wong, “The SVB Tremors Will Shake SoftBank,” Wall Street Journal, March 16, 2023, https://www.wsj.com/articles/the-svb-tremors-will-shake-softbank-dc7fab4↩

- [3]Jacky Wong, “The SVB Tremors Will Shake SoftBank,” Wall Street Journal, March 16, 2023, https://www.wsj.com/articles/the-svb-tremors-will-shake-softbank-dc7fab4↩

- [4]Gerrit De Vynck, Caroline O’Donovan, and Naomi Nix, “The age of the Silicon Valley ‘moonshot’ is over,” Washington Post, March 2, 2023, https://www.washingtonpost.com/technology/2023/03/02/big-tech-moonshots-google-meta-amazon/↩

- [5]Arjun Kharpal, “Japanese giant SoftBank dumps its entire stake in Uber as losses mount at its investment unit,” CNBC, August 8, 2022, https://www.cnbc.com/2022/08/08/softbank-sells-entire-stake-in-uber-as-vision-fund-losses-mount.html↩

- [6]William D. Cohan, “Two Days in the Valley,” Puck, March 15, 2023, https://puck.news/two-days-in-the-valley/↩

- [7]David Benfell, “The Federal Deposit Insurance Corporation dilemma,” Irregular Bullshit, March 14, 2023, https://disunitedstates.com/2023/03/14/the-federal-deposit-insurance-corporation-dilemma/↩

- [8]Charlie Wolfson, “Neighborhood groups try to curb shootings as Pittsburgh’s mayoral campaign puts political focus on gun violence,” Pittsburgh City Paper, October 20, 2021, https://www.pghcitypaper.com/pittsburgh/neighborhood-groups-try-to-curb-shootings-as-pittsburghs-mayoral-campaign-puts-political-focus-on-gun-violence/Content?oid=20401296↩